Strait Risk, Oil Spike, and the OXY Setup: 001

Geopolitics, Breakouts, and a Buffett Discount

Welcome to my first Substack post. Let’s get right into it.

On Thursday, Israel launched an attack on Iran. The initial market reaction was swift, S&P 500 futures dropped nearly 2% overnight, but just as quickly shrugged it off. By Friday’s close, we were back up ~1% from those lows.

The S&P is sitting right above its 21-day moving average. Keep an eye on that green line next week, a daily close below it would warrant a more risk-off stance in equities. We’re still 88 points below the February high and about 25% off the April 7th lows.

If you’re running light on hedges and we open flat or green, it’s worth considering some Summer Hedges (downside protection), just in case we get hit with SUMMERTIME MADNESS. One clean setup to hedge:

5800/5400 put spread on SPX (8/15 expiry), closed Friday at 55.90

SPY equivalent: 580/540 put spread, closed at 5.92

Now, let’s talk oil.

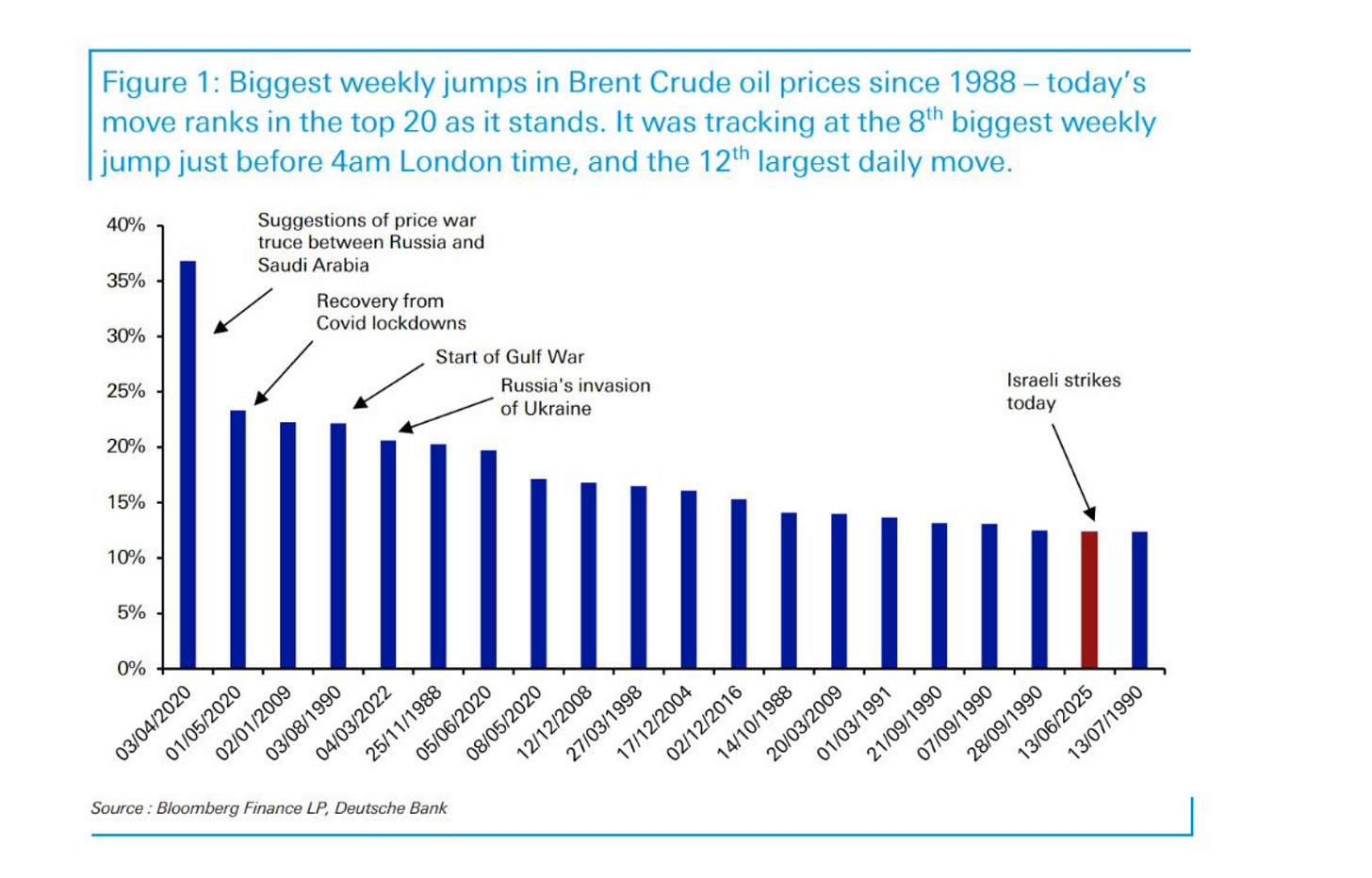

Here’s the move in context:

According to Deutsche Bank via Bloomberg, Thursday/Friday’s jump was one of the top 20 largest two-day moves in oil.

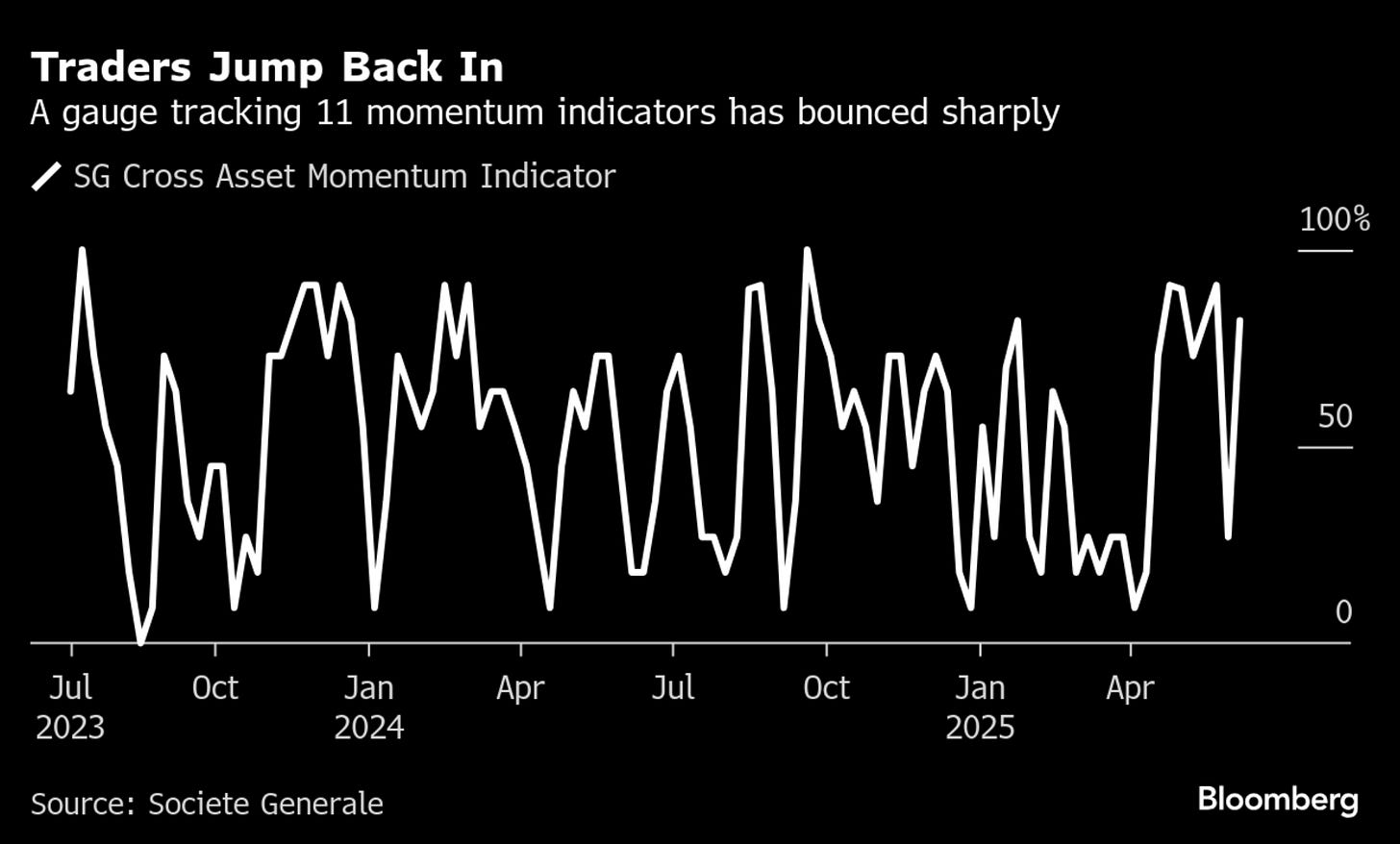

Momentum’s picking up. Societe Generale’s Cross Asset Momentum Indicator is flashing similar levels to July 2023. Back then, oil ripped 33% from the low $70s to $95 over two months.

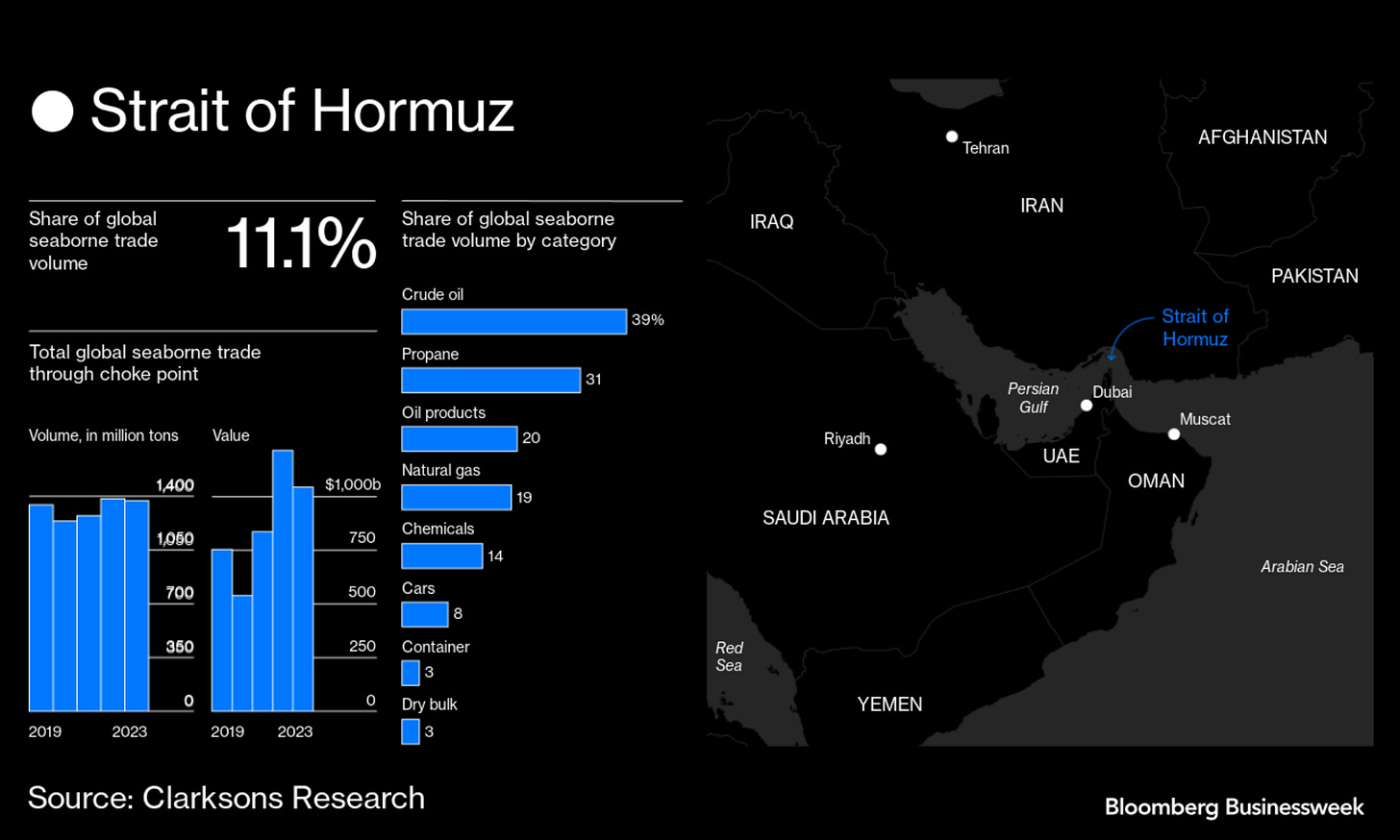

Geopolitically, the Strait of Hormuz is back in focus. That sliver of water moves 39% of global seaborne crude volume, and it’s one of the most critical chokepoints in the world. Reuters flagged how Iran may be preparing to “choke off” the Strait, or at least rattle the saber. Even the threat of that is bullish for crude.

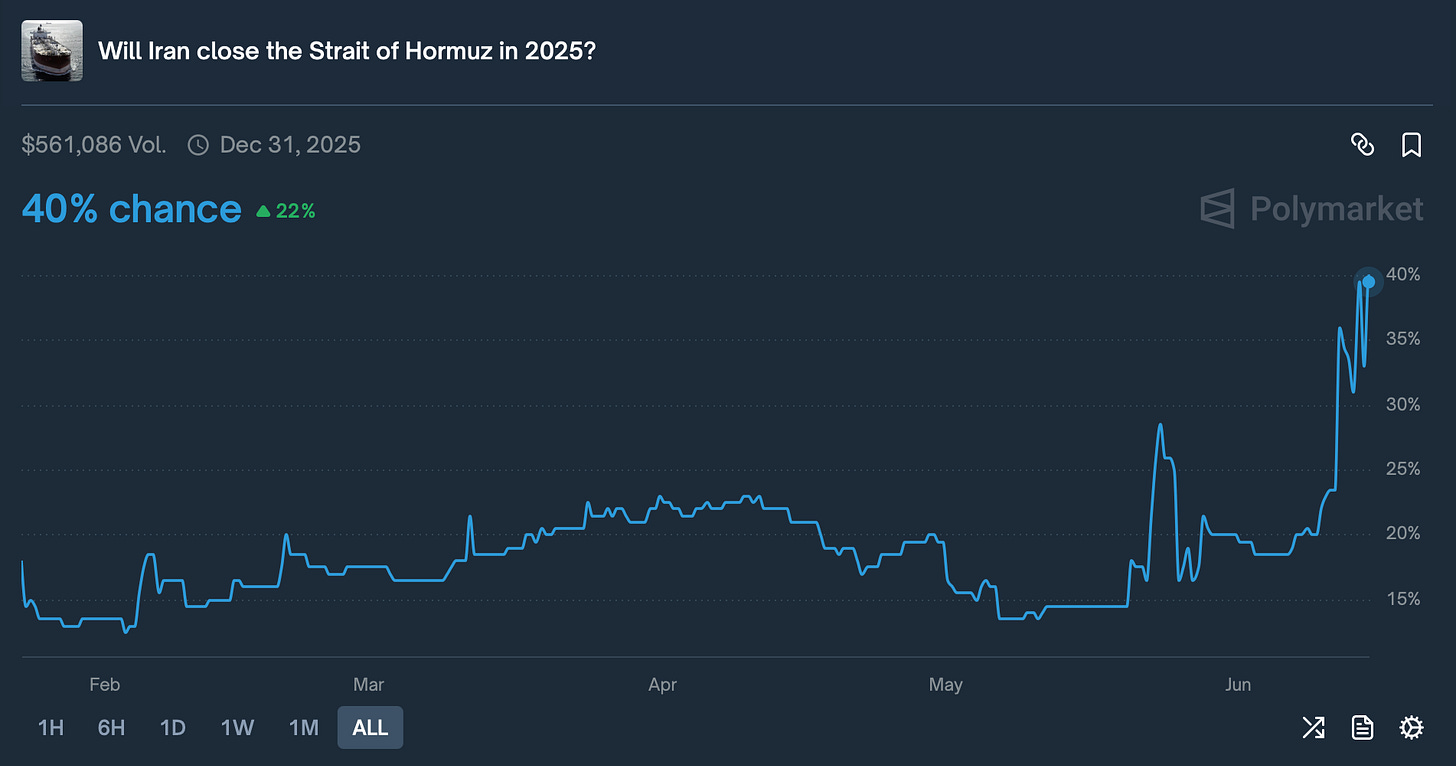

Over on Polymarket, odds of a wider conflict hit 64% intraday and settled around 40%.

The Trade: OXY

I flagged this chart in real time, during market hours, on Friday via Twitter (X). OXY on the weekly breakout, sitting cleanly above its 21-day.

Here’s how to play it:

Structure A:

Long stock outright.

Structure B (preferred):

Long $50C Jan 16, 2026 @ 3.60, Short $40P Jan 16, 2026 @ 2.05 = Net cost: 1.55

This gives you leveraged upside and a defined cushion. If you’re assigned on the short puts, you own OXY at $40, a level Berkshire could only dream of.

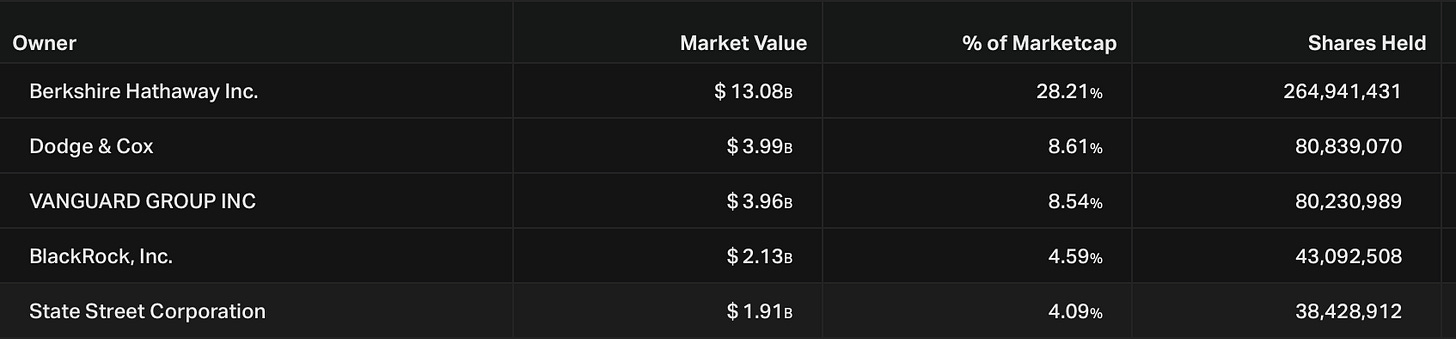

Speaking of Berkshire, they own ~28% of OXY with an average cost around $54. Current price is still ~15% below that.

Fundamentals Are Improving

CEO Vicki Hollub put it plainly:

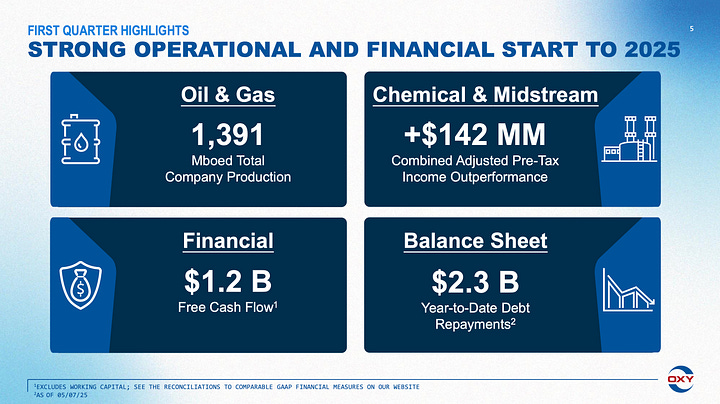

“Over the past 10 months we've repaid a total of $6.8 billion, reducing annual interest expense by $370 million… All 2025 maturities have been retired, providing us with a more comfortable runway over the next 14 months.”

Cleaner balance sheet. Impoved debt.

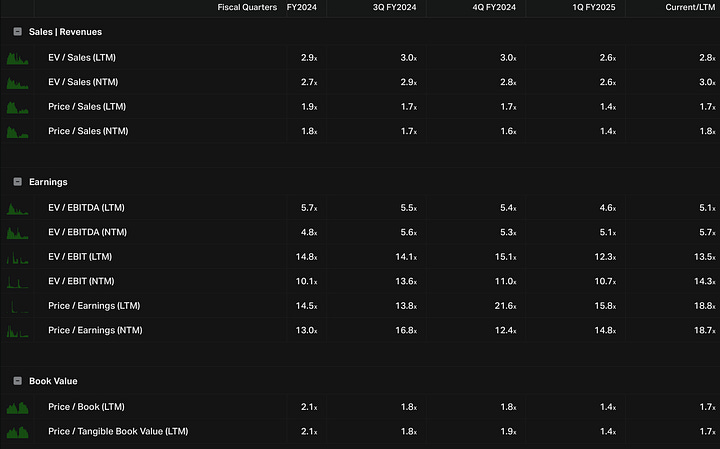

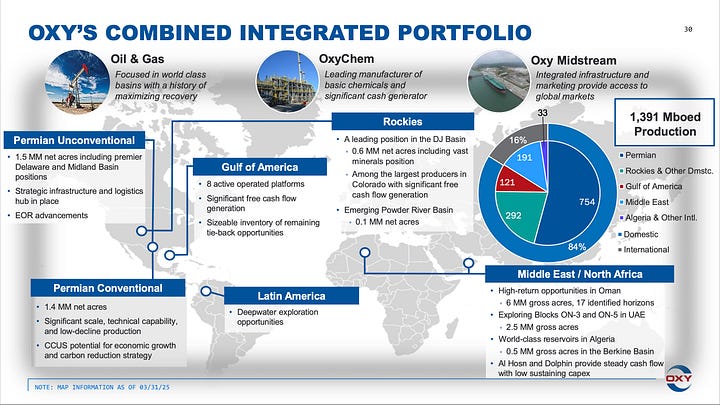

A few more data points on OXY…

More to come soon. We’re always hunting.

Until then, stay sharp.

Like + Retweet if you enjoyed.

Subscribe for More.

—Drew