$VOYG | Voyager Technologies: The Quiet Giant Fueling the Next Space Race

From Palantir alliances to Air Force contracts, $VOYG is building a war chest in orbit, here’s why it could be the most under appreciated IPO of the year. 003

Mission Brief: Voyager Technologies VOYG 0.00%↑ Is Prepping for Liftoff

When it comes to space, defense, and data fusion, most companies are either too slow, too niche, or too bureaucratic. Not Voyager. This newly public aerospace and defense firm is flying under the radar for now, but behind the scenes, it’s stacking some of the sharpest alliances and contracts in the sector.

Fresh off its June IPO, Voyager Technologies VOYG 0.00%↑ priced at $31 and spiked over $70 on day one before retreating into the low $40s. That cool-down offers more than just a second chance, it offers the kind of entry that would make Cathy Woods blush. The company raised $383 million in its offering.

Strategic Partnerships: This Is No Solo Mission

Voyager’s partnership roster reads like a who's who of global tech and defense heavyweights.

Most notably, Palantir Technologies has deepened its alliance with Voyager. The two are co-developing advanced payload systems for military satellites, combining Palantir’s battlefield-proven AI software with Voyager’s proprietary signal-processing hardware. Their latest system integrates RF and imagery analysis with autonomous decision-making onboard satellites. Translation: real-time orbital intelligence.

And then there’s Starlab… Voyager’s joint venture with Airbus, Mitsubishi Corporation, and MDA Space. This isn’t science fiction. It’s the commercial successor to the International Space Station, and Palantir is locked in as Starlab’s exclusive data infrastructure provider. With NASA and the U.S. Space Force among its clientele, Voyager isn’t betting on the future of space… it’s building it.

Leadership with Gravitas

You can tell a lot about a company by who’s steering the ship.

Voyager’s CEO Dylan Taylor isn’t just a suit, he’s a space tourist turned executive, having flown with Blue Origin. He’s one of the rare leaders who understands both the investor psyche and the engineering gruntwork behind orbital systems. The board includes retired General William Shelton, former Commander of the U.S. Air Force Space Command, and Marshall Smith, a former senior NASA systems engineer now heading Voyager’s space division. This is a team that knows how to navigate Washington’s alphabet soup and launch hardware that actually works.

The Fundamentals: Early-Stage, Deep-Tech Growth

Voyager is still early in its revenue journey, pulling in ~$148 million in the past year with a mix of defense contracts, space infrastructure services, and R&D platforms. NASA alone accounts for a good chunk of its business. And with a few acquisitions under its belt since 2019, Voyager has quietly built a vertically integrated space- and defense-tech platform without the bloated cost structure of its legacy peers.

Yes, the company is still posting net losses (~$66 million last year), but that’s standard fare for deep-tech builders at this stage. What’s compelling is the roadmap: government demand is intensifying for space situational awareness, autonomy, and secure AI data flow, and Voyager sits right at the intersection.

The Setup: Right Place, Right Sector, Right Time

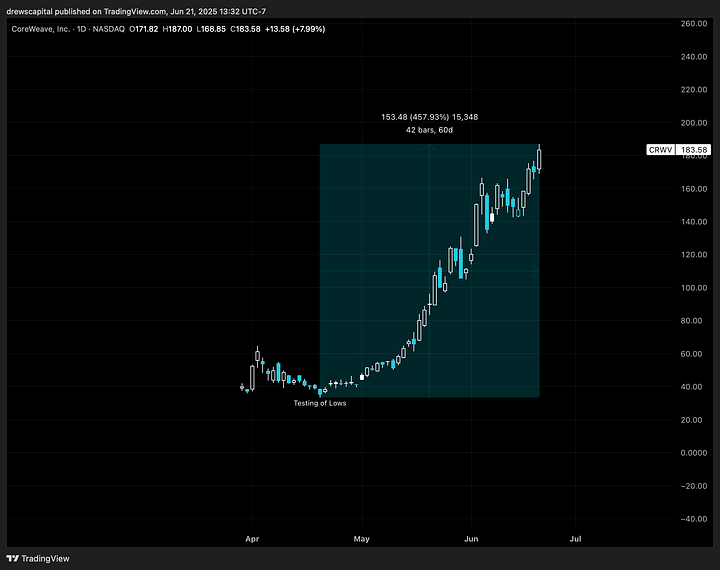

The IPO market is back, and the recent pops in names like Circle Internet Group Inc. (CRCL) and CoreWeave Inc. (CRWV) signal an appetite. Voyager, with its dual exposure to space and AI, is uniquely positioned. While its current valuation looks rich, that’s par for the course when you’re selling what Uncle Sam is urgently buying (just look at Palantir).

If Voyager secures even a fraction of the multi-billion-dollar pipeline emerging from DoD, Space Force, and NASA contracts, that valuation starts to look conservative. And let’s not forget the optionality in Starlab, if commercial space stations take off in the next decade, Voyager becomes the next-generation Lockheed Martin of orbit.

Final Word: A Mission Worth Taking

Voyager isn’t a meme stock, and it’s not trying to be. But it is benefiting from the same scarcity squeeze that’s sending defense-tech IPOs vertical. More importantly, it’s backed by real contracts, real tech, and a leadership team with enough firepower that would make Bill Ackman beg for a seat at the table.

For investors looking to position ahead of the crowd, while everyone’s still stuck reading headlines about Palantir or Rocket Lab, Voyager offers a sharp, speculative play on the future of secure, autonomous, AI-enabled space defense.

All of this is without even mentioning the possibility of the Golden Dome.

Don’t blink. The next leg higher might come with a launch window.

See you next time. I’ll be out there, hunting for what’s next.

– Drew

Disclaimer: This post is for informational and entertainment purposes only and does not constitute financial, investment, or trading advice. This is a speculative trade, not a recommendation. Always do your own due diligence and consult a licensed financial advisor before making investment decisions.