$U | Unity at the Edge: Betting on AI, Spatial Computing & Digital Infrastructure

Why Unity’s Vector AI, enterprise traction, and Unity 6 upgrade position it for post-AI platform dominance... A much deeper dive

Company Summary

Unity Software Inc. U 0.00%↑ is evolving from a dominant mobile game engine into a high-margin, cloud-native platform powering the next generation of real-time 3D (RT3D) applications. With significant traction in gaming, digital twins, and immersive enterprise workflows, Unity now sits at the intersection of AI-native monetization, industrial digitization, and spatial computing.

Recent operational discipline, narrowing GAAP losses, and a pivot toward platform-as-a-service (PaaS) economics suggest a compelling risk-reward skew. For investors looking to front-run secular trends across AR/VR, simulation infrastructure, and machine-learning optimization, Unity offers asymmetric long-term optionality.

Business Model Evolution

Unity’s platform is now bifurcated into two core segments:

Create Solutions: Unity Editor, Unity 6, simulation environments, and enterprise-grade RT3D tooling.

Grow Solutions: Unity Ads, Analytics, and the newly launched Vector AI, an in-house machine-learning monetization engine.

With the launch of Unity 6 and early success of Vector, Unity is establishing itself as more than a gaming engine, it’s becoming the core infrastructure layer for interactive, real-time content.

Unity 6: The Next-Gen RT3D Platform

Unity 6 represents the most significant upgrade to the company’s core engine in years. This release improves real-time rendering, supports the latest platforms (including XR), and introduces enterprise-grade features.

Key Enhancements:

Performance & Graphics: Major improvements in rendering quality, lighting systems, and runtime performance, creating more immersive experiences across mobile, console, and XR.

Cloud-Native Collaboration: Enhanced tooling for large-scale, team-based projects with deep integration into AWS and Azure.

AI & Simulation Ready: Built for digital twin environments, autonomous systems training, and real-time industrial simulations.

Cross-Platform Deployment: Developers can build once and publish to mobile, PC, console, web, and XR… drastically improving time to market.

Unity 6 adoption has gained momentum in both gaming and enterprise, confirming its role as a foundational layer for Unity’s high-margin PaaS transition.

Digital Twins: The Real-Time Mirror of Industry

What Are Digital Twins?

Digital twins are dynamic, virtual representations of physical systems, environments, or assets. These models are continuously updated via sensors, IoT data streams, and cloud integrations, allowing real-time simulation, monitoring, and prediction.

Why It Matters:

Predictive Maintenance: Detect and prevent system failures before they happen.

Operational Optimization: Improve efficiency, throughput, and cost control.

Immersive Training: Risk-free, high-fidelity simulation environments.

Design & Prototyping: Virtual testing prior to real-world deployment.

Unity’s Advantage:

Real-Time 3D Engine: Scalable, photorealistic rendering.

Cross-Vertical Reach: Active in automotive (BMW), AEC, manufacturing, and energy.

Cloud Deployments: Unity integrates with AWS and Azure for enterprise-scale digital twin deployment.

AI-Simulation Synergy: Unity 6 is tailored to AI-driven use cases, including robotics and system diagnostics.

Strategic Impact: Digital twins are a cornerstone of the post-AI infrastructure wave. Unity's role as a simulation-first platform makes it a key enabler of industrial digital transformation.

Unity Vector: AI Monetization Reimagined

What is Vector?

Vector is Unity’s next-gen AI-powered advertising and monetization platform. It replaces Audience Pinpointer with a self-learning system that adjusts campaigns in real-time to boost installs, retention, and ROI.

Key Features:

Behavioral Prediction: Tracks live in-app behavior to drive precision targeting.

Automated Optimization: Learns and improves continuously, removing the need for manual adjustments.

Transparent Reporting: Advertisers gain access to actionable, granular performance data.

Early Success:

Voodoo and other major publishers reported improved ROAS and reduced user acquisition costs… signaling strong product-market fit.

“The early success of Unity Vector and continued strong demand for Unity 6 underscore our positioning as the leading integrated platform supporting developers across the full lifecycle of game development” – Matthew Bromberg, Unity CEO (Q1 2025)

Enterprise Expansion: Unity Beyond Gaming

Unity's adoption curve is accelerating across multiple enterprise sectors:

Automotive: BMW uses Unity for digital twin simulations, immersive design reviews, and production-line optimization.

AEC: Architects and engineers simulate real-time building behavior and optimize design collaboratively.

Healthcare: Hospitals use Unity to train surgeons, simulate procedures, and enhance patient education.

Unity’s flexibility, developer-friendly tooling, and cloud delivery model have made it a backbone of enterprise simulation.'

AR/VR Readiness & Spatial Dominance

Unity remains the dominant engine for building AR/VR experiences. As Apple Vision Pro, Meta Quest, and enterprise XR platforms scale, Unity’s embedded presence ensures it captures value across:

AR-powered product demos

Virtual collaboration and training

Immersive prototyping

Mixed-reality digital twins

Hardware is catching up to software. Unity is already the default creative engine.

Indie Developer Moat

Unity powers nearly 50% of global mobile games, particularly among indie developers. This base provides a sticky, recurring-revenue foundation.

Why they stay:

Lower development barriers

Strong asset store and community support

Cross-platform ease

The developer flywheel is alive and well… and still spinning.

Market Opportunity - TAM

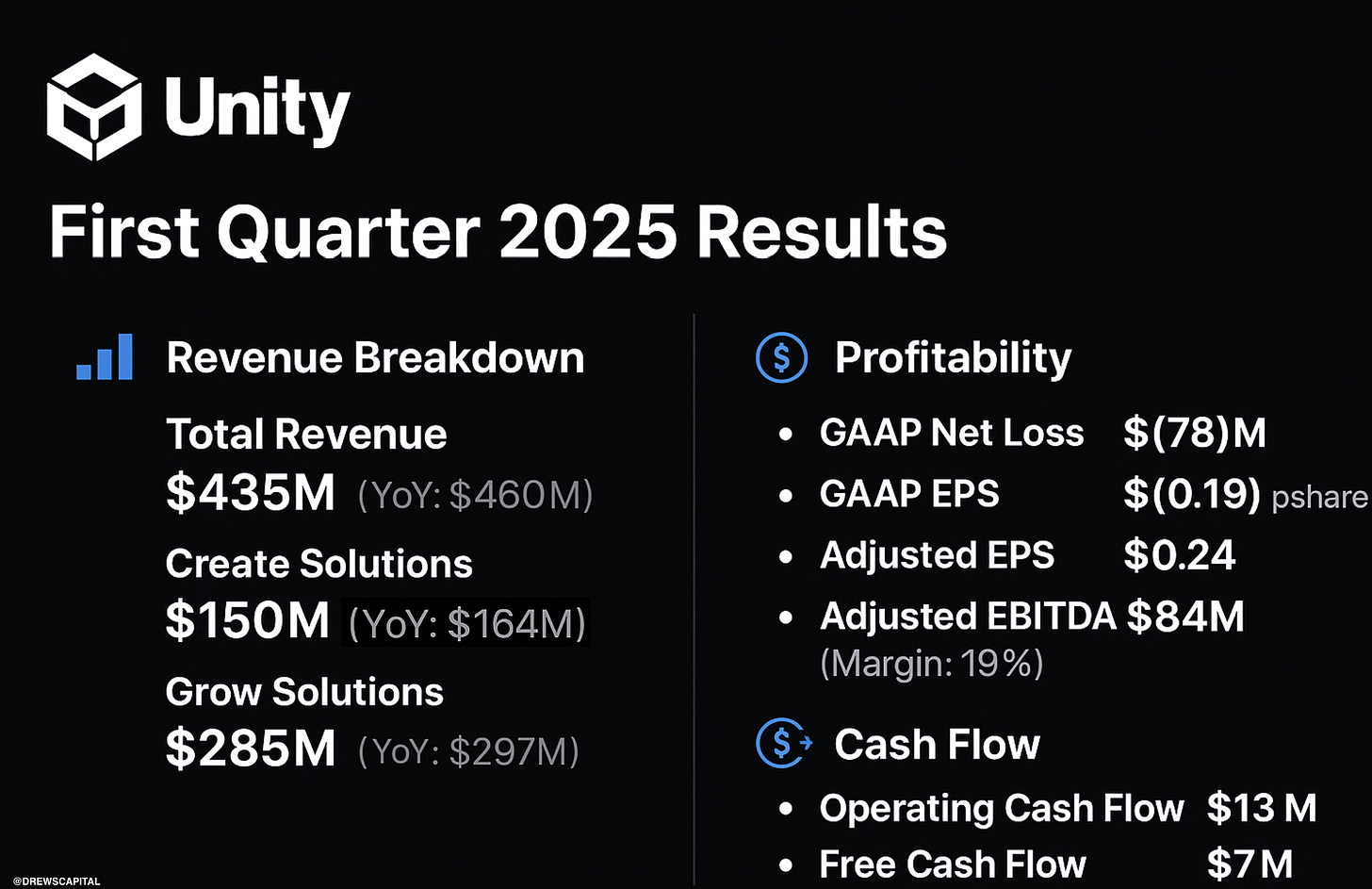

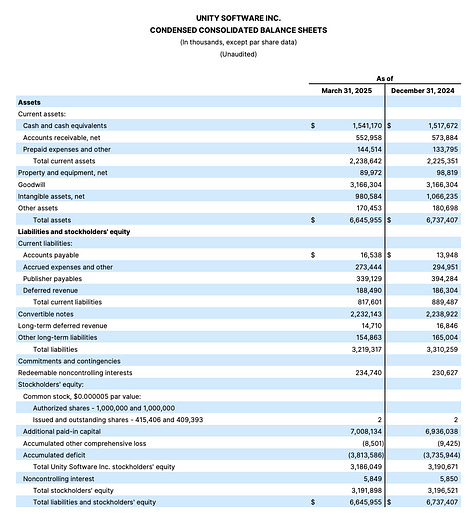

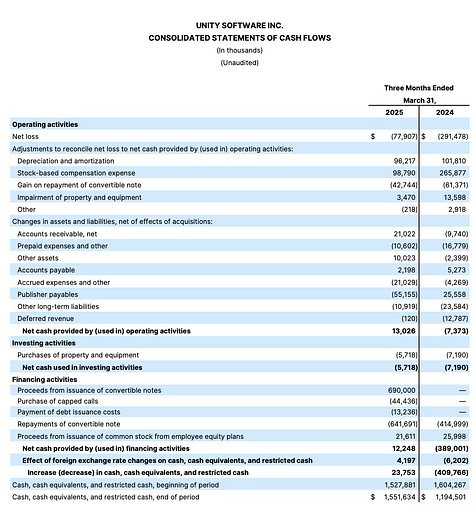

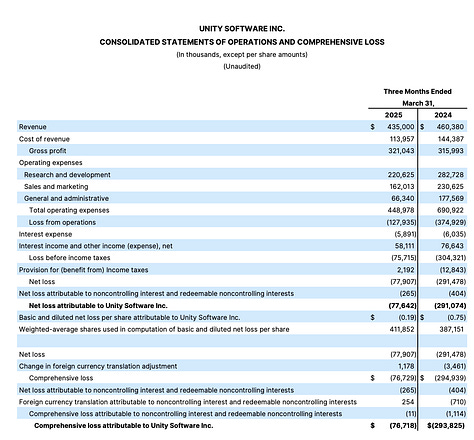

Financial Snapshot (Q1 2025)

Net loss margin improved from (63%) to (18%) YoY.

Positive free cash flow indicates better capital efficiency.

Q2 2025 Guidance: Revenue $415–$425M; Adjusted EBITDA $70–$75M.

Key Financials (Q1 2025)

Investment Thesis

Unity represents a high-beta vehicle for capturing upside in digital transformation. With a cleaned-up cost base, a broadened market beyond gaming, and clear product-market fit across AI-driven monetization and digital infrastructure, Unity is positioned for a long-duration rerating.

The engine is running leaner. The products are more differentiated. The market is expanding.

Investors aren’t just buying a game engine, they’re underwriting the infrastructure layer for real-time, AI-native, immersive applications.

TLDR

Unity is no longer just a game engine. It’s transforming into a high-margin platform powering AI-driven ads (Vector), real-time 3D industrial simulations (Unity 6), and immersive enterprise experiences (digital twins, AR/VR). With improving financials, growing enterprise adoption (BMW), and platform-wide stickiness, Unity is laying the groundwork to be the infrastructure layer of the spatial computing era.

I’ll leave you with these memes

Here’s a link to my earlier, more entertaining Unity write-up… packed with memes, loaded with speculation, and featuring a trade setup:

See you next time. I’ll be out there, hunting for what’s next.

- Drew

Disclaimer: This post is for informational and entertainment purposes only and does not constitute financial, investment, or trading advice. This is a speculative trade, not a recommendation. Always do your own due diligence and consult a licensed financial advisor before making investment decisions.